Current mortgage and refinance rates for December 23rd, 2022 Rates down

Table of Content

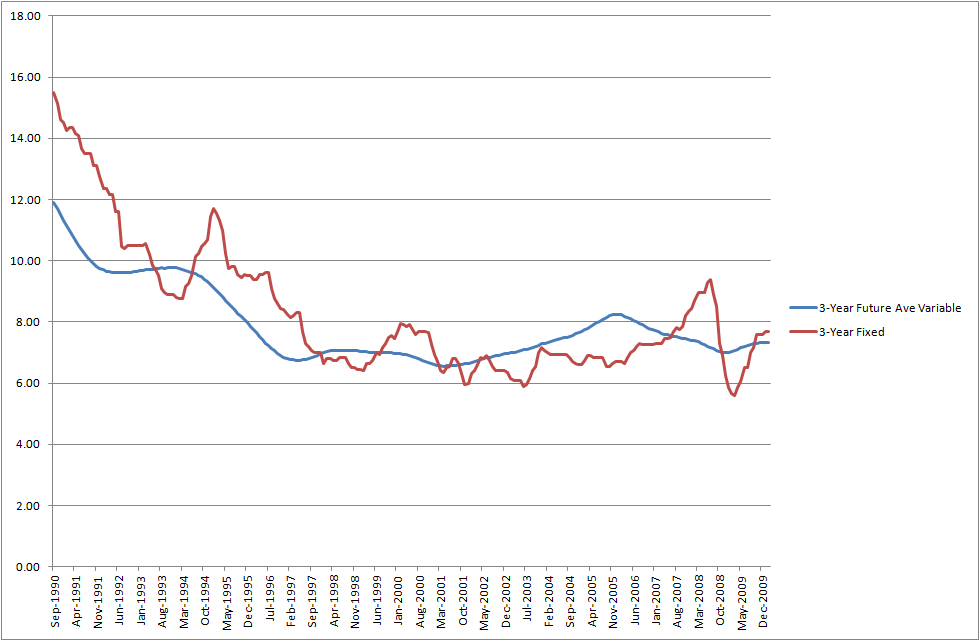

However, the rate you get when your current deal ends may be more expensive than you’re paying now so it’s more important than ever to shop around. With an adjustable-rate mortgage , the rate is fixed for an initial period of time—typically the first five years—before it becomes variable for the rest of the loan term. These loans have become increasingly popular this year as the rate is lower than that of a 30-year fixed mortgage. However, ARMs are seen as riskier because you are betting that rates will be lower when the adjustment period comes. "The market may be thawing since mortgage rates have fallen for five straight weeks," NAR chief economist Lawrence Yun said in a press release.

Mortgage rates listed on lender websites are based on a sample borrower and don’t necessarily represent the actual rate a borrower will get. There are a ton of options out there and it pays to do your research. Spring EQ cannot use a borrower’s home equity funds to pay Spring EQ non-homestead debt at account opening. To access HELOC funds, borrower must request convenience checks.

How we make money

It’s similar to a college application — your credit score is like your GPA or your SAT score. “It’s an important metric that’s easily understood and lets decision-makers compare various applicants. If you have a borderline credit score, lenders may take an even closer look at the other factors such as your income, your debt-to-income ratio and how you’ve managed specific accounts. In general, higher credit scores give you better odds of qualifying for a lower interest rate on a loan.

One of the best things to do when home buying is to compare offers from mortgage lenders and shop around for lower rates. Check out Credible to compare mortgage and refinance rates across multiple lenders. Getting a good interest rate on your mortgage relies on a variety of factors, but it's important to determine what a good mortgage rate really means. You can explore mortgage rates across multiple lenders on Credible without affecting your credit score. It’s always a good idea to improve your credit score before applying for a mortgage, so you get the best terms possible.

Mortgage Rates by State

This is why it’s important to shop around and get pre-approved so you can compare current mortgage rates across multiple lenders and see the best rate you qualify for. Visit an online mortgage broker like Credible to get personalized rates within 3 minutes without affecting your credit score. For instance, decide if you want to tap your home equity, lower your monthly payments or switch between a fixed mortgage and an adjustable-rate mortgage. If you want the predictability that comes with a fixed rate but are looking to spend less on interest over the life of your loan, a 15-year fixed-rate mortgage might be a good fit for you.

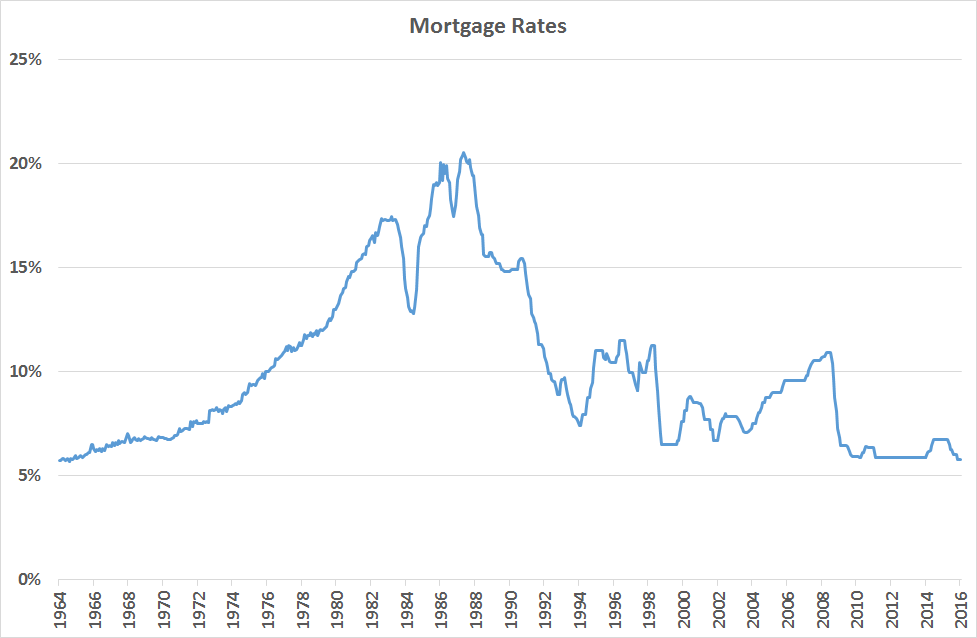

Mortgage rates are now hovering around 6% or more, as a comparison. In general, the credit requirements for FHA loans tend to be more relaxed than those for conventional loans. To qualify for a low down payment mortgage (currently 3.5%), you’ll need a minimum FICO score of 580.

How to find a good mortgage rate

The net change has been roughly 0.25% from the lows to today's highs. The culprit was a poorly received monetary policy move in Japan that sent shockwaves throughout global markets. This isn't the sort of thing that's likely to have an ongoing impact on US rates in the short term. At NextAdvisor we’re firm believers in transparency and editorial independence. Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners.

As you can see, just one percentage point could save you nearly $50,000 in interest payments for your mortgage. Locking in low mortgage and refinance rates can save you thousands of dollars over the life of your loan. If you’re on a SVR, locking into to a fixed rate not only means you will have certainty over how much you’ll be paying on your mortgage each month but you may also find your repayments drop too. There is no “official” minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score won’t necessarily prevent you from getting a mortgage.

Meanwhilethe best rate on a 10 year fix this month is from Halifax at 4.04%. You’ll need a deposit of 40% and it has an arrangement fee of £999, with £250 cashback. For purchases, the best rate on a 10 year fix this month is also from Halifax at 4.50%. You’ll need a 40% deposit and it has an arrangement fee of £999.

Since lenders are required to provide a standardized Loan Estimate, you can easily compare offers and find the one that’s most advantageous for you. Whether a mortgage APR is good depends not only on your credit but on the overall market conditions. For the last few years, 3-4% was suitable for 30-year fixed-rate mortgages.

To qualify for the lowest interest rate, your credit should be as strong as possible. While some experts say they’re hopeful that interest rates won’t rise further this year, others say the increases will likely continue into early 2023 until inflation is under control. A home equity loan can give you a lump sum of cash at a low interest rate, but you must use your home as collateral to secure the loan.

As a rule of thumb, refinancing can save you money if you can secure an interest rate that’s around 1% lower than your existing rate. And the number of homeowners with rates well above the current market rates has dwindled dramatically as rates have risen. The annual inflation rate came in it at 8.2% in September, according to the latest data from the Bureau of Labor StatisticsAnd that’s bad news for refinance rates. The central bank raised rates again at its November meeting — but what comes next is a toss-up. Some anticipate more forward marching for mortgage rates, possibly tapping 8 percent, while others say subsequent Fed hikes have already been accounted for and rates should stabilize. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

At the current average rate, you'll pay principal and interest of $632.73 for every $100,000 you borrow. The average rate for a 30-year fixed mortgage is 6.51 percent, down 9 basis points from a week ago. Last month on the 23rd, the average rate on a 30-year fixed mortgage was higher, at 6.78 percent. You can save thousands of dollars over the life of your mortgage by getting multiple offers.

Comments

Post a Comment